Initial Coin Offering Best Practices

For the uninitiated, Bitcoin and other cryptocurrencies might seem like a runaway train when compared with other investments – but cryptos are a rapidly maturing asset class with an evolving infrastructure that is moving towards standardization as Initial Coin Offerings (ICOs) become a preferred method for startups seeking capital infusions. ICOs are always being considered by fast growing companies that have passed the Series A and Series B capital raising stages and now closing in on larger capital raises to propel those companies further and to provide monetization for early investors.

For the uninformed or those who might have missed the thousands cryptocurrency memos published in the past several months, Bitcoin was launched in 2009 and introduced the first ever blockchain; a public, decentralized ledger that confirms the data in transactions across several different servers instead of having to send funds through an intermediary such as a bank. This disintermediation is revolutionary. Several entrepreneurs soon realized it has a much broader use case than just cryptocurrencies, and have held ICOs to fund their visions. In various cases, the ICOs often include the use of ‘smart contracts’, which has the phrase implies, is best described as a multi-dimensional contract that can be updated on a continual basis.

ICOs represent a sea change in how startups can raise money. In the traditional startup land, companies typically start with a “friends and family round” to fund the ‘proof of concept stage.’ These companies then move down the private placement path to raise additional capital and allocate those proceeds to ramp the business, with the end game goal that brings them to the holy grail of capital formation: the Initial Public Offering (IPO). The public offering event enables the company to further bolster working capital and provides early investors an exit ramp by which they monetize their investments by selling part or all of their equity stakes on a public stock exchange. But, this old-school approach is often a long and expensive slog, which is counter-intuitive to the Cool Kid generation whose constituents are accustomed to doing everything at lightning speed pace. The traditional IPO process entails months of paperwork filing with red tape regulators, embarking on a traveling circus for “road shows” where they pitch investors in conference rooms, and of course, sucking up pesky legal fees, accounting fees, investment banking fees to underwriters and brokers that shave as much as 20% from the net proceeds to an issuer. Let’s not forget the non-trivial, post IPO regulatory costs and burdensome shareholder reporting tasks that public companies are obligated to adhere to for Ad infinitum.

The way an ICO works is relatively simple: Startup A issues a proprietary crypto coin or “token” that can act as a utility token or store of value in the business initiative, or can be securitized for use in crypto funds. This coin, let’s call it StartUp Coin, is then held by investors in a digital vault called a wallet. Once the startup reaches certain goals, this coin can be used in exchange for services offered, convertible into equity ownership in the enterprise or even kept as a long-term investment.

This ain’t your father’s IPO. ICOs can accomplish the same capital raise goal as a traditional private placement or an Initial Public Offering in a fraction of the time, at a fraction of the costs and best still, without the long tail burden of regulatory requirements imposed on public companies. As evidenced by more than a few of the dozens of ICOs launched during the past year alone, “all one needs to do” is publish a whitepaper (the Cool Kids phrase for business plan), list the offering on one of the various bitcoin-centric platforms that accommodate ICOs, then advance a public solicitation for direct funding. Barring a lengthy road show process, which the smarter Cool Kids are actually conforming to, a capital raise can be completed within a matter of weeks. Even when using outside consultants for proper document preparation and excluding pre-offering advertising costs, Issuers can retain 99% of the amount raised vs the 80%-85% retained by their IPO counterparts, and without the need to budget upwards of hundreds of thousands each year for public stock exchange fees, regulatory compliance and investor relations departments.

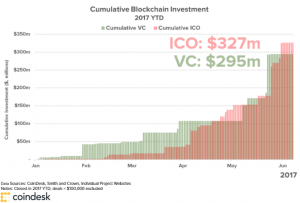

As of the end of November 2017, ICOs raised nearly $4 billion, much more than early-stage Venture Capital funding rounds. According to media reports; some of the more successful ICOs, including Filecoin and Tezos, raised hundreds of millions of dollars. Instead of paying 20% or more in fees to the IPO ecosystem, almost all of this money went directly to these issuing firms and was instantly available as working capital to the issuers. While this has led to some bad actors, the majority of these offerings are used to fund well-intentioned tech entrepreneurs looking to build game changing products or services powered by blockchain and distributed ledger platforms.

As of the end of November 2017, ICOs raised nearly $4 billion, much more than early-stage Venture Capital funding rounds. According to media reports; some of the more successful ICOs, including Filecoin and Tezos, raised hundreds of millions of dollars. Instead of paying 20% or more in fees to the IPO ecosystem, almost all of this money went directly to these issuing firms and was instantly available as working capital to the issuers. While this has led to some bad actors, the majority of these offerings are used to fund well-intentioned tech entrepreneurs looking to build game changing products or services powered by blockchain and distributed ledger platforms.

Coins really only have one utility — to act as simple stores of value with limited-to-no other functionality. That store of value can represent a broad array ‘value’, however the underlying ‘engine’ that powers the coin includes a sophisticated ledger—which can be described as a multi-dimensional spread sheet that tracks and updates and ensure the intrinsic value of the information contained therein is secure and transferrable only at the direction of the holder

This vast swing in funding mechanisms has many traditional investment banks on Wall Street scrambling to pivot to cryptos. Many of these firms often derive the bulk of their revenues from IPO consulting and fees. Should that line of business dramatically decline, or even dry up entirely, it could drive many industry stalwarts out of business.

As framed by a December 2017 Fintech Association of Hong Kong white paper (not to be confused with ICO-type white paper), best practices for holding an ICO should conform with those of traditional private placement and IPO initiatives. The conservative view is there needs to be proper documentation that explains what the fundraise is for, how the proprietary coin will work, what that coin or token represents in terms of value, and the roadmap for the company’s development and service offerings. Those white papers are generally consistent with traditional business plans found within the exhibits section of an offering prospectus.

It is no surprise that the ICO revolution has already led to a formidable cottage industry comprised of ICO domain professionals who can handle the documentation task and pre-funding marketing processes to help founders navigate the complex waters to a successful offering.

Among these service providers is Prospectus.com, a firm with a formidable legacy and global footprint providing traditional business plan and private placement document writing as well as IR, PR and corporate communications services, it has more recently expanded into the ICO silo. Compromised of seasoned corporate finance professionals, startup mentors, former investment bankers and securities attorneys, this boutique is complemented by a captive network of consultants in major cities throughout the globe and is well-positioned to write white papers, offering memorandums that conform with the spirit of legacy regulatory guidelines, investor presentation decks and even handle marketing and public relations.

“This year has seen an explosion of interest in ICOs,” said Prospectus.com’s Evan Fisher, a former sell side investment banking veteran now consulting fintech firms on ICO best practices. “And, having the proper documentation in place for both investors and regulators is the most important part of any successful fundraise.”

Fisher is experienced in helping startups frame their value proposition properly and stresses founders need to ensure that when regulators do start to take a closer look at ICOs and cryptocurrencies, that all the necessary documentation is on file and easily obtainable.

Though having a successful ICO is usually easier and costs less than an IPO, the penalties for fraud remain the same. Make sure you document everything and have an experienced partner in your corner to ensure you are meeting obligations to both investors and, eventually, regulators.

Contact Us Today To Schedule Your Free Consultation

Read More

- Prospectus Writing

- IPO Stock Exchange Listing

- Bond Offerings

- Feasibility Study

- Hedge Funds and Mutual Funds

- Offering Memorandum

- Private Placement Memorandum

- Offering Circular

- Explanatory Memorandum

- Information Memorandum

- Fund Setup Formation

- Securities Identifiers

- Registration and Filing

- Legal Work

- Valuations

- Escrow Services

- Business Plans